Small steps can relieve stress over finances

by Julie Estlick

Lately when Mary talks to someone feeling the mental strain of financial struggles, she imagines them bobbing in the deep blue ocean, ready to slip under the waves and she is throwing out a lifeline. As a consumer credit counselor, she listens intently and offers concrete solutions to get her client back on solid ground during a pandemic that has sunk the budgets of so many Americans.

U.S. adults reported having significant anxiety and stress about personal finances before the beginning of the COVID-19 pandemic, according to a George Washington University study, and most participants said that the pandemic made their financial anxiety worse. After 18 months of uncertainty, increased unemployment, decreased wages, and lost health insurance for millions, many families have burned through their savings, and a growing number are frightened about losing their homes.

“It is NOT being financially irresponsible to be impacted by COVID,” says Melinda Opperman, president and chief relationship officer for the nonprofit Consumer Credit Counseling Services (CCCS). “There is no shame in asking for help and there are programs and services ready to assist you.”

Opperman represents agencies across the country that help people get out of debt, repair their credit, and find long-term solutions to financial problems, including housing. Counseling, budget planning, and financial education services are free. Debt management programs have small fees, usually offset by savings through the programs.

Last year, CCCS served over 29,000 people nationwide. The average client had around $62,000 in unsecured debt such as credit card bills and medical bills, with a total of seven creditors. (Home mortgages and car loans are debts that are ‘secured’ by the asset itself, which can be taken if the owner doesn’t pay.) Anyone can receive confidential support from CCCS, you do not need to be a citizen, and no government benefits will be impacted. And there is no minimum amount of income or debt required to receive one-on-one help.

Last year, CCCS served over 29,000 people nationwide. The average client had around $62,000 in unsecured debt such as credit card bills and medical bills, with a total of seven creditors. (Home mortgages and car loans are debts that are ‘secured’ by the asset itself, which can be taken if the owner doesn’t pay.) Anyone can receive confidential support from CCCS, you do not need to be a citizen, and no government benefits will be impacted. And there is no minimum amount of income or debt required to receive one-on-one help.

Here’s how it works: After you provide some basic income and expense information to your certified financial counselor, they will design a plan with you and your creditors that may include lower payments, lower interest rates, or waived late fees as part of an agreement to pay off your debts within five years (sometimes sooner). Counselors also check eligibility for getting help with the cost of health insurance, food, and other safety net programs you may not realize you can access.

During this unusual time, CCCS employees received special empathy training as well as suicide prevention tools to work with callers deeply impacted by the pandemic. “I consider our counselors ‘financial first responders,’ ” Opperman says. “For many people, a financial counselor is the first one they’ve talked to about their anxiety and financial worries. Some are feeling extremely lost and desperate, and their sadness is just profound.” Clients are encouraged to reach out to a mental health advisor when appropriate.

Indeed, financial problems can often lead to intense mental, emotional, and even physical responses that should not be ignored, mental health experts say.

Action brings relief

Embarrassment over high credit card debt, fears about large student loans never getting paid off, and regret over past money decisions are very common, says Jennifer Dunkle, a licensed professional counselor who specializes in financial therapy and mental health issues. “I try to help my clients realize that they are not their debt, they are not their net worth statement, and their debts and assets do not equal their value as a person.”

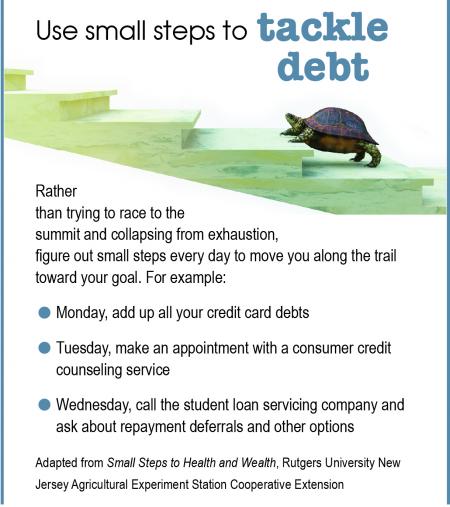

While it may be uncomfortable, discussing money issues can improve our well-being. That’s because putting off financial concerns means that there is “a constant, underlying feeling of stress and tension that we hope will magically get better, but in actuality won’t get better until we face it,” Dunkle explains. “The ‘known’ reality—even if unpleasant—is in fact easier for us to cope with than the ‘unknown.’ ” For example, adding up credit card debts and other liabilities and seeing the figures in black and white means that it becomes a problem that can be dealt with, rather than an ongoing source of anxiety.

In the past year, Dunkle has counseled individuals so stressed out about financial hardship that they suffer panic attacks. But she’s also seen people feel a great sense of relief when they start to take action. “Believing that we can do something like asking for and getting a deferment on a debt helps us gain confidence. When we take proactive steps to help ourselves rather than having things happen to us, there is a reduction in feelings of helplessness and hopelessness.”

Housing help

Loss of shelter is an enormous stressor, particularly along the Front Range where housing costs have skyrocketed. Demand for housing counseling services has increased by 50 percent at GreenPath Financial Wellness, a national nonprofit with a branch office in Fort Collins. “Housing concerns about eviction and foreclosure usually go hand-in-hand with personal debt issues,” says Jeffrey Arevalo, a GreenPath certified financial counselor with more than 15 years of experience.

Colorado, like many states, is working to get federal emergency funds into the hands of renters and homeowners impacted by COVID-19. There is still time to apply for up to 15 months’ worth of assistance—past, current, and future payments—through the Colorado Emergency Rental Assistance Program, including landlords who can apply on behalf of tenants (see Resources box).

So if you’re in a financial pinch, reach out for help at one of the resources below.

|

Resources |

|---|

|

Colorado Emergency Rental Assistance Program (ERAP) |

|

Connections COVID support line |

|

Consumer Credit Counseling Services |

|

Consumer Financial Protection Bureau |

|

GreenPath Financial Wellness |